proposed estate tax law changes 2021

Two of the most significant proposed changes include. The exemption was indexed for inflation and as of 2021 currently stands at 117.

New Estate And Gift Tax Laws For 2022 Youtube

The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax.

/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. 2021-2022 town of brookhaven 2021-2022 louis j. Free Inheritance Information For You Your Lawyer.

Tax guidances by tax type. Marcoccia receiver of taxes taxable districts code location valuation rate tax code location valuation rate tax school districts library districts county districts. Regulations and regulatory actions.

Ad Compare Your 2022 Tax Bracket vs. Learn More About The Adjustments To Income Tax Brackets In 2022 vs. Conspicuously absent from the Biden Proposals is any mention of reducing the estate gift and GST tax exemption amounts.

An estate tax would never make a farm insolvent. Doubling of the exemption and inflation adjustments is. Tax code taxable districts tax code taxable districts 100c01 sc1 lx1 h01 h02 t01 t02 t05 wd1 c02 c04 m01 p01 fa1.

Laws of New York State New York State Senate. This is because tax rates are based on the total taxable assessments in school district or municipality. On September 13 2021 the House Ways and Means Committee released its proposal for funding the 35 trillion reconciliation package Build Back Better Act detailing multiple changes to current tax law in order to increase tax revenue.

The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed for inflation prior to the scheduled sunset on January 1 2026. The law would exempt the first 35 million dollars of an individuals gross taxable estate or 7 million for a married couple from estate tax. One of the potential tax law changes that would take effect at the beginning of 2022 is a reduction of the Federal Estate Tax Exemption.

How do I protect my assets from estate tax. Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026. Understand the different types of trusts and what that means for your investments.

A persons gross taxable estate includes the value of all assets including even proceeds payable via life insurance policies. This proposed legislation would impact among other things estate gift and generation-skipping transfer tax exemptions valuation discounts and grantor trust rules. Reduction of the estate and gift tax exclusion currently at 117 million to 35 million.

Ad Get an Estate Planning Checklist More to Get the Information You Need. The current lifetime exemption is 117 million dollars for an individual and 234 million for a. The generation-skipping transfer tax GST tax exemption amount will also decrease from 117 Million per person to 5.

Potential Estate Tax Law Changes To Watch in 2021. Among these changes are proposals that could significantly modify planning for individuals looking to transfer assets out. This means the current inflation-adjusted exemption of 11700000 per person would be reduced to approximately 6000000 per person for transfers occurring after December 31 2021.

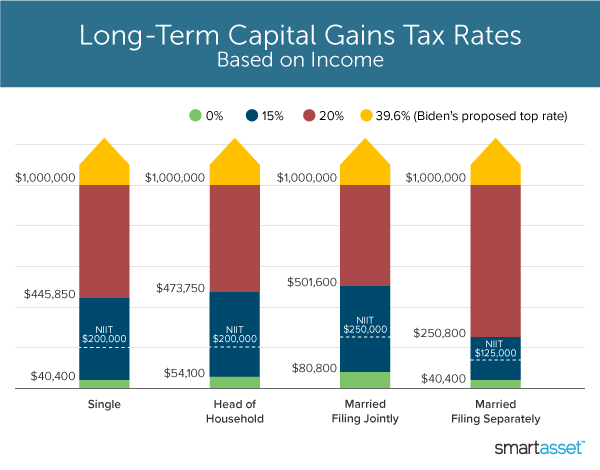

Most of these proposed changes would be effective as of January 1 2022 however the administration has stated that the increases in the long-term capital gainqualified dividend tax rate would be retroactive to April 28 2021. Amount of each estate 5 million in 2011 indexed for inflation is exempted from taxation by the. Together with the transfer tax the net worth of this estate would be reduced by almost 40 by the two taxes.

Proposals to decrease lifetime gifting allowance to as low as 1000000. Tax guidances NYT-G An NYT-G is an informational statement of the departments interpretation of the law regulations and Department policies and is usually based on a particular set of facts or circumstances. Imposition of capital gains tax on appreciated assets transferred during life or at death.

On September 13 the House Ways and Means Committee made public its proposed tax plan the revenue from which would fund President Bidens Build Back Better spending package. The proposed effective date for the estate and gift tax changes would be for death. One other concern of this tax is that it is based on deferred gain and not net worth.

Your 2021 Tax Bracket To See Whats Been Adjusted. Reduction in Federal Estate and Gift Tax Exemption Amounts. Under the current proposal the estate.

After 2025 with the reduction in the estate tax exclusion this owners estate would owe 1715334 in estate taxes. The 2017 Trump Tax Cuts raised the Federal Estate Tax Exemption to 1118 million for tax year 2018. At the moment there are proposed changes in the law that may result in the 117 million estate and gift tax exemptions being reduced to 35 million for the estate and 1 million for gift taxes.

Ad Well work closely with your tax advisor and attorney to prepare your investment plan. November 16 2021 by admin. Tax rates are not accurate indicators of how much more a school district or local government is collecting in taxes this year.

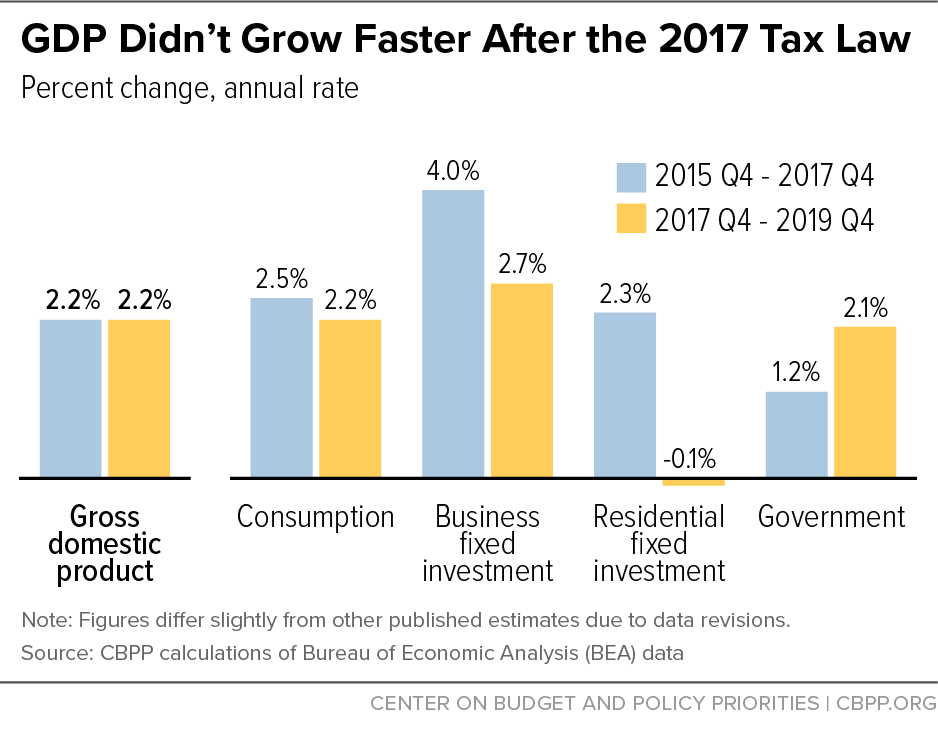

Estate and gift tax exemption. As of January 1 2021 an individual may give up to 11700000 during life or at death without incurring any federal gift or estate tax. The Effect of the 2017 Trump Tax Cuts.

However on October 28 and then again on November 3 the House Rules Committee. Reducing the Estate and Gift Tax Exemption. President Biden has proposed major changes to the Federal tax laws some of which are sought to be effective earlier in 2021 ie we are already operating under these changes if they later become adopted as compared to the effective date the new tax law changes may be passed by Congress or a later effective date such as beginning January 1.

Thankfully under the current proposal the estate tax remains at a flat rate of 40. Since Massachusetts currently has no gift tax our planning for most of our families has been to make large gifts of up to 117 million to immediately lower the Massachusetts. If the value of property in the jurisdiction changes that will skew the tax rate.

With indexation the value was 549 million in 2017 and with the temporary. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022.

Time To Change Your Estate Plan Again

Corporate Lobbying Campaign Against Biden Tax Proposals Is Inaccurate Unpersuasive Center On Budget And Policy Priorities

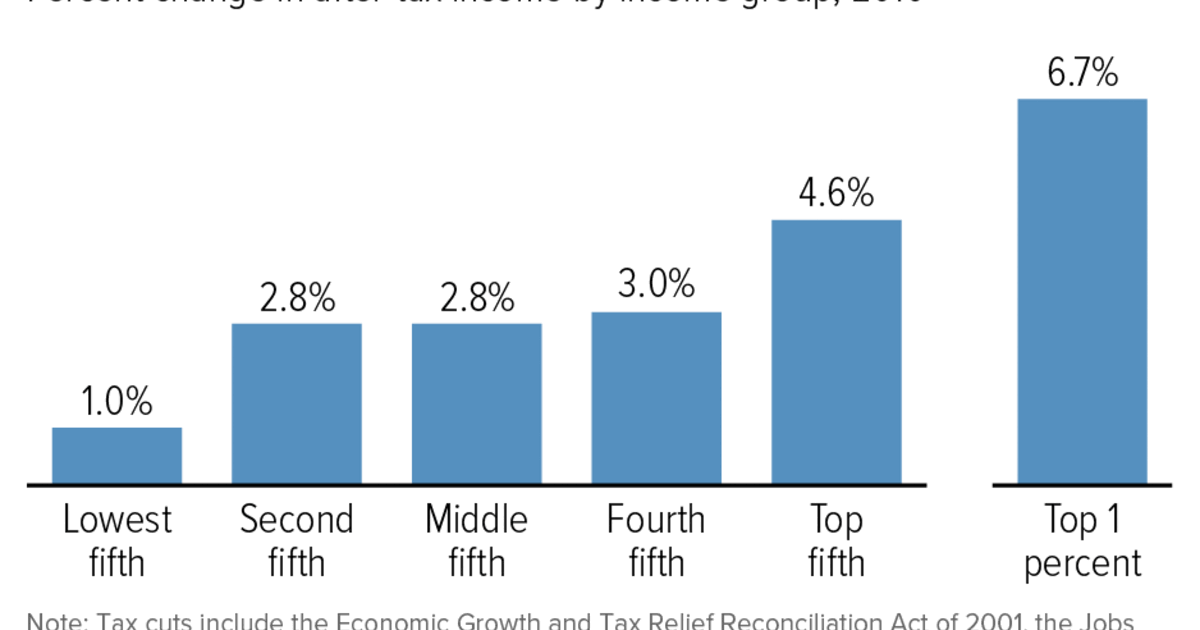

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

2022 Updates To Estate And Gift Taxes Burner Law Group

Corporate Lobbying Campaign Against Biden Tax Proposals Is Inaccurate Unpersuasive Center On Budget And Policy Priorities

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

Proposed Tax Changes For High Income Individuals Ey Us

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Income Tax Law Changes What Advisors Need To Know

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Income Tax Law Changes What Advisors Need To Know

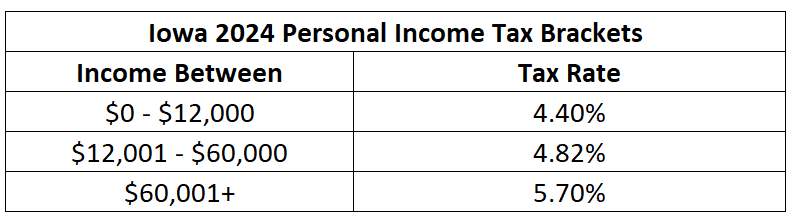

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 Definition

2022 Eisneramper Tax Planning Guide

What S In Biden S Capital Gains Tax Plan Smartasset

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel